Finding A Consumer Problem Worth Solving (Ep. 2)

Our second lesson in The Brand Method® explores why successful brands start with problems, not products - and exactly how to identify the opportunities worth pursuing.

The Brand Method is a foundational series I created for early-stage entrepreneurs building their first brand - or their first real one. It’s for the woman whose mind won’t stop racing with ideas, or the founder who’s launched but feels more overwhelmed than confident. While these lessons were made for solopreneurs, brand leads and senior marketers might still appreciate the refreshed clarity that comes from revisiting first principles.

A successful brand exists to solve our pain points better than what’s already out there.

While it might seem obvious, you'd be surprised how many entrepreneurs skip this foundational step. They're attached to their specific product idea and try to persuade people to buy into that, rather than building their brand around solving existing consumer problems.

Lack of clarity around the specific problem your brand exists to solve could be what’s holding you back from growth. So if you’re not crystal clear on it, this is the moment to pause and figure that out.

What a Problem-First Approach Actually Gives You

When you lead with a problem (instead of just your product idea), three things happen:

You build something people truly value.

You're not guessing what people might want, you're addressing what they already need in their lives.

It automatically makes you a notch more innovative than competitors.

Most businesses flooding the market are following product-first approaches. So when you start from the problem, you become much better at innovating and standing out.

You develop a foundational brand vision that helps you expand strategically.

Knowing what you stand for gives you a natural sense of direction. You’ll know what makes sense to launch next and what to say no to.

The UKLash Case Study

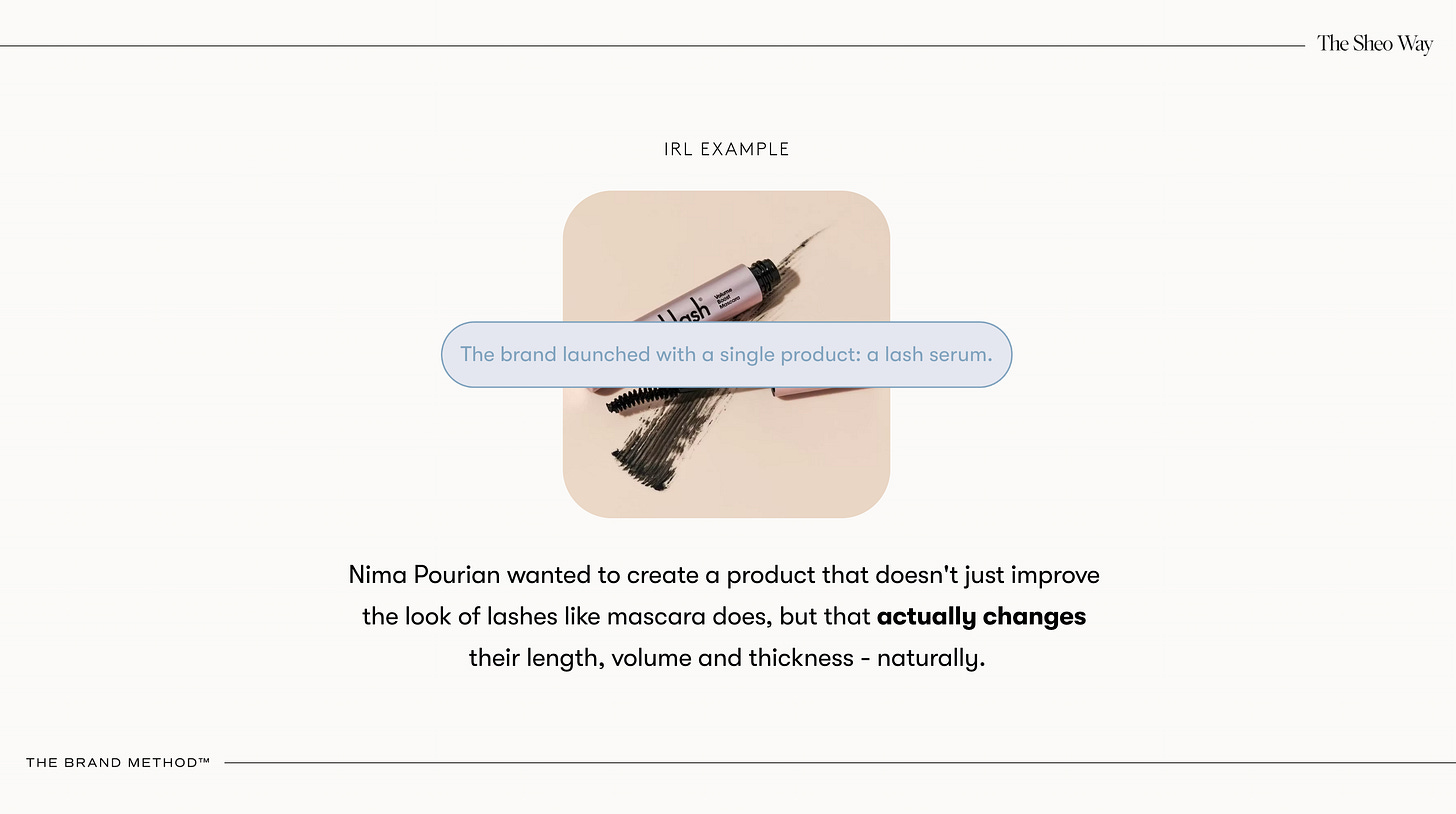

Consider UKLash, founded by Nima Purian.

Instead of launching “another mascara brand,” Purian identified a specific problem: existing products only improved the look of lashes temporarily, but didn't actually change their length, volume, and thickness. People didn’t just want their lashes to look longer, they wanted them to actually grow longer.

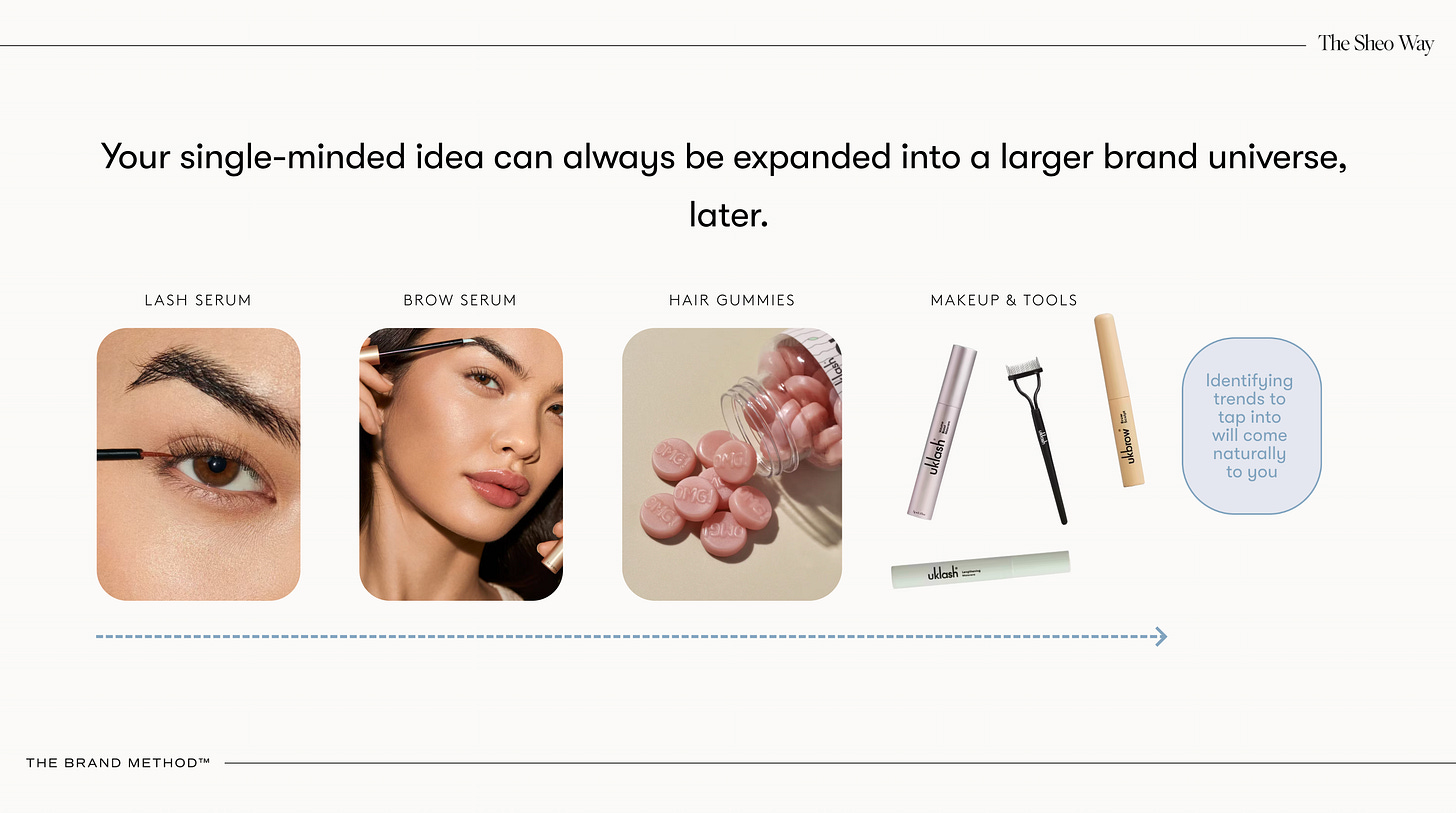

This single-minded focus led to launching with just one product - a lash serum. The results speak for themselves: UKLash has become one of the best-selling brands across major retailers like Beauty Bay, Feelunique, and QVC, shipping to over 118 countries. One bottle of their products sells every 30 seconds worldwide.

Once they established authority in natural lash enhancement, expansion became logical. They moved into brow serums, hair gummies, and complementary tools like lash separators, all anchored in that same core product. The strategic effort paid off, and the brand’s growth felt effortlessly coherent instead of confusingly scattered.

The Cost of Product-First Thinking

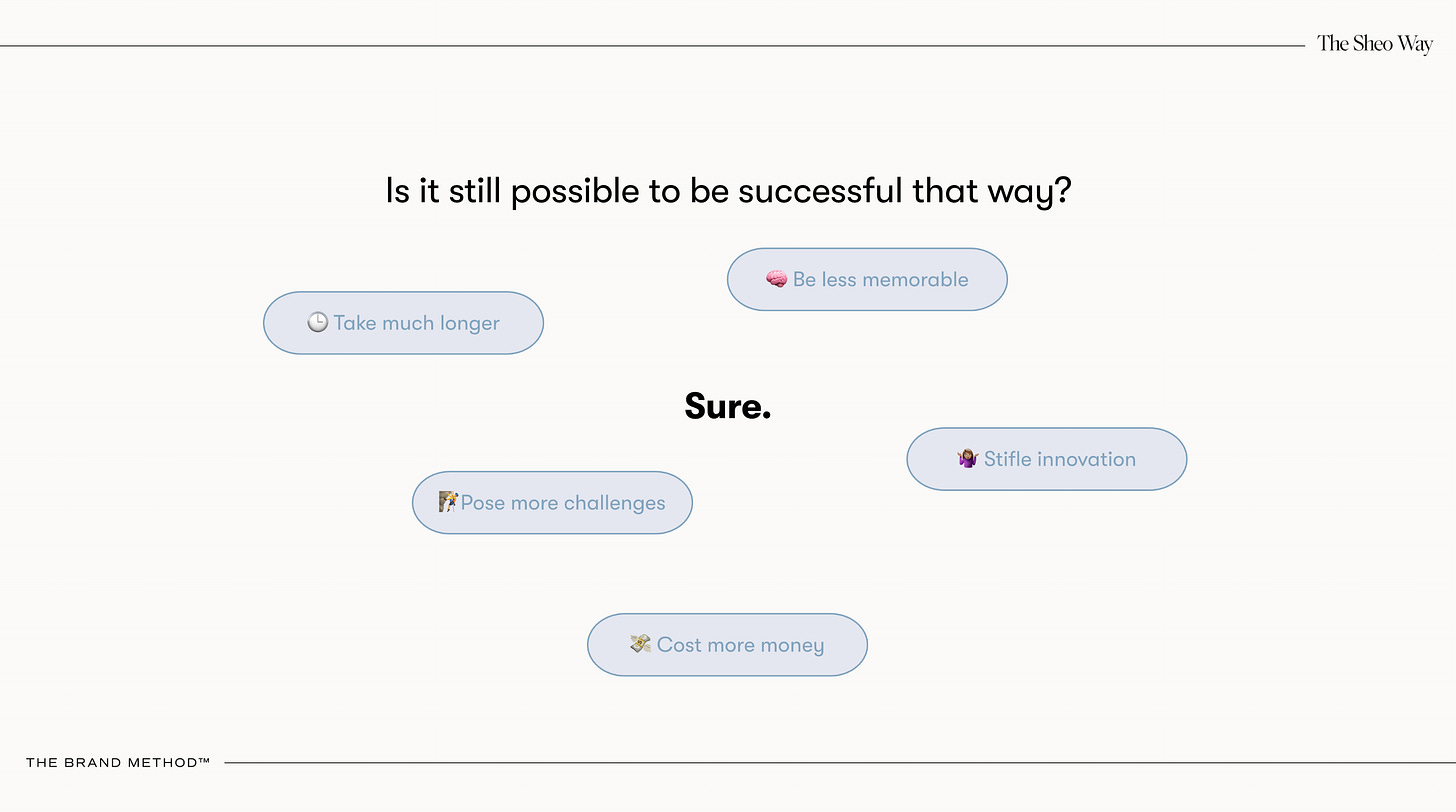

Imagine if Pourian had taken a product-first approach and thought, “People want long lashes, so I'll launch a new mascara.”

They would’ve been competing with every other cosmetics brand, offering nothing particularly new and missing the core problem that consumers still faced with existing solutions.

Your messaging won’t land as well, because it will feel too general

You’ll spend more money testing what works

The idea won’t feel distinct enough to attract press or funding

You're unlikely to create anything memorable because you're pursuing the status quo

The Problems Solved by Brands You Love

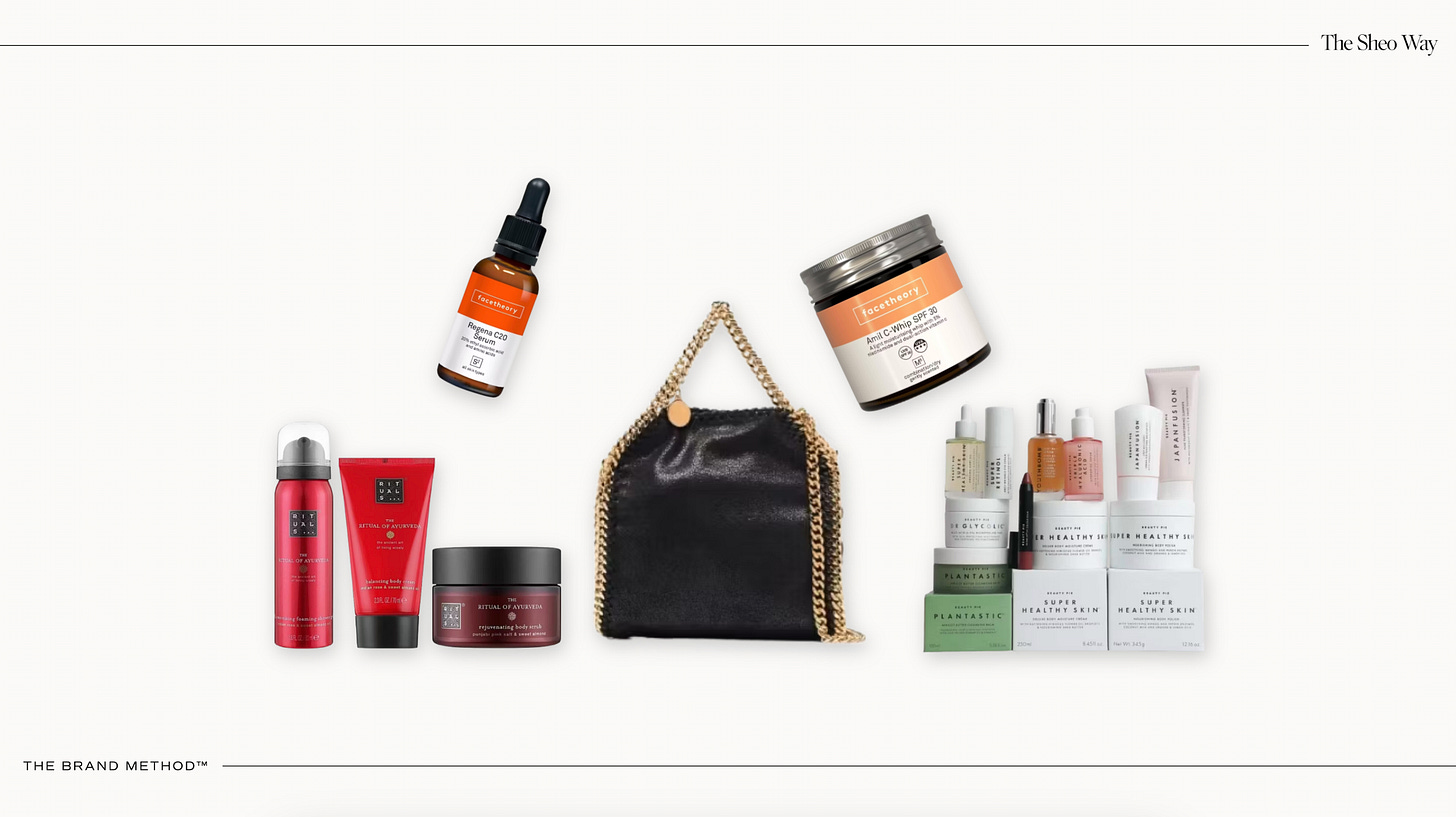

Stella McCartney: People wanted designer furs and skins without harming animals → sustainable luxury, so well-made they feel more luxurious than the real thing.

Rituals: Noticed that daily hygiene routines had become boring and mundane → daily rituals that use scent, texture, and aesthetic to evoke the senses and spark joy.

Beauty Pie: Premium beauty was locked behind luxury markups → a luxury beauty buyers' club offering premium quality without the traditional price tag.

Facetheory: Observed that while demand for Vitamin C was growing, consumers found it too costly and were frustrated that it quickly lost efficacy → a serum using a more stable version of Vitamin C for longer shelf life, with a simple formula and packaging to drive down costs while improving effectiveness.

Notice how that last example isn’t even a brand concept, just a single product. This reinforces how important problem-first thinking is for every product decision beyond your initial brand launch.

Consumers are no longer buying products simply because they belong to your brand. Even if their first purchase is driven solely by your branding, you won't get repeat purchases if the product doesn't solve a problem for them.

This isn't a one-time exercise; it's a mindset that should be born with your business and stay with you as it grows. Every time you're concepting a new product, the question should be: “Why would anyone want this? What problem does this solve?”

The brands that consistently ask this question are the ones that build lasting businesses rather than just momentary success.

So, How Do You Actually Find the Problem?

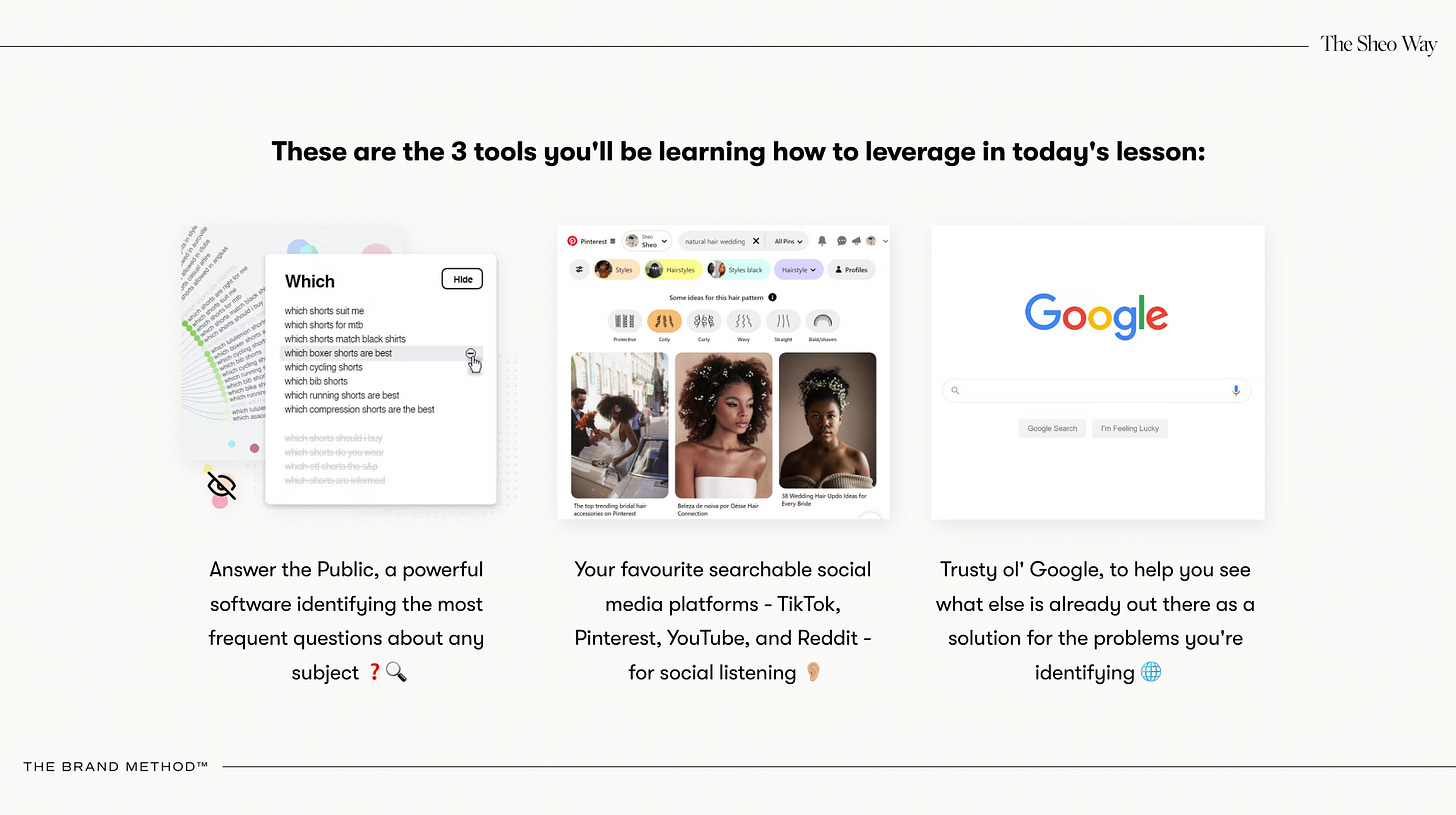

Understanding why problem-first thinking matters is just the beginning. The real challenge lies in systematically uncovering these opportunities. Here are three reliable methods for identifying consumer problems worth solving:

1️⃣ Search Data Analysis

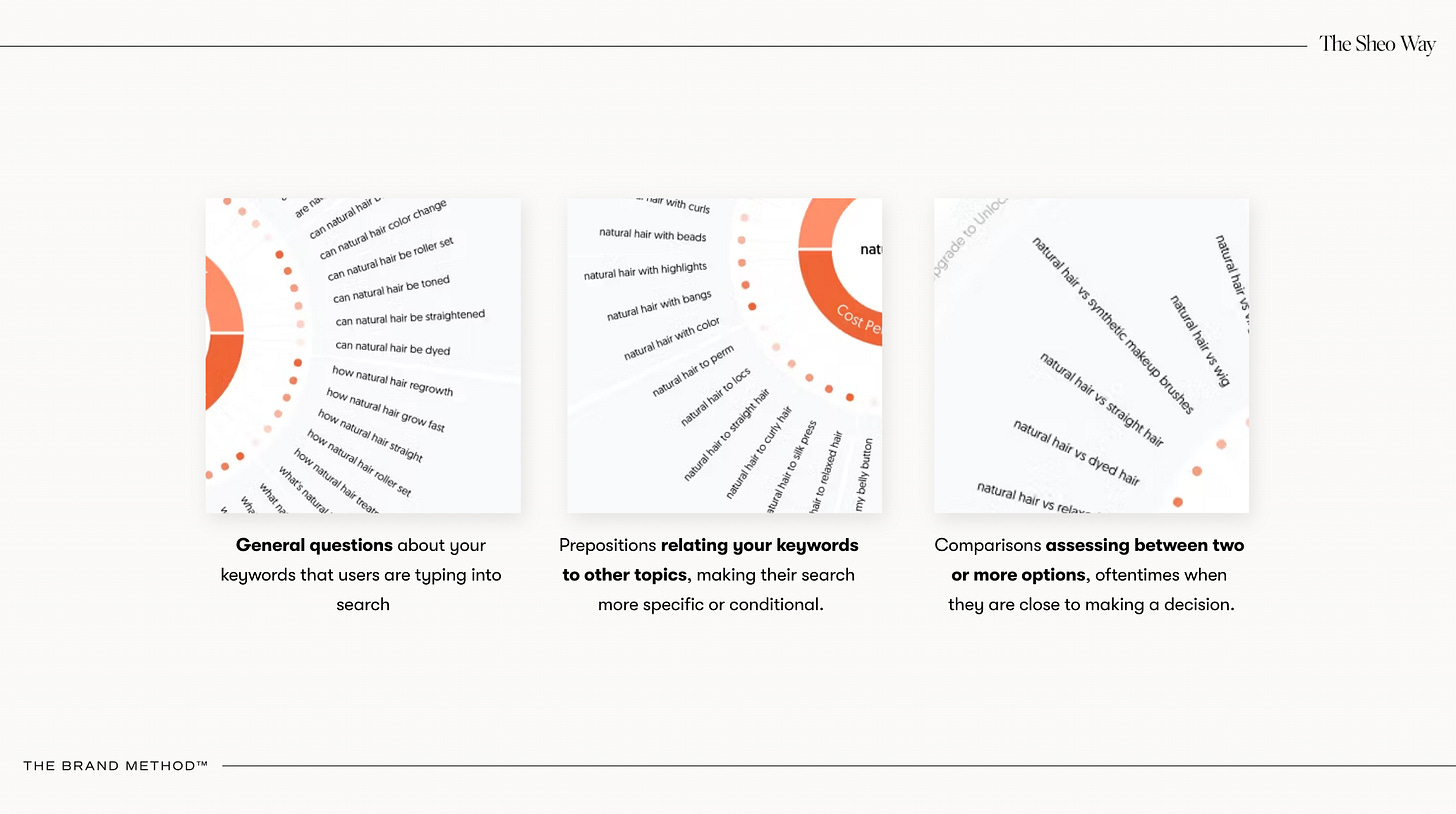

Start with Answer the Public, a tool that reveals the most frequent questions about any subject. This approach works because it shows you exactly what people are actively searching for. These are their real, unfiltered curiosities and pain points.

The process is straightforward: enter your keywords, select your target country, and analyse the results.

You'll see searches categorised by type - general questions (‘how can natural hair grow fast’), conditional searches (‘natural hair with bangs’), and comparisons (‘natural hair versus synthetic’).

Note down your findings, focusing on the most common as well as the unexpected ones that helped spark inspiration.

💡 Pro tip: Run multiple related searches to find patterns leading to less predictable insights. If you're researching "natural hair," also search "curly hair" to capture different terminology around the same problems.

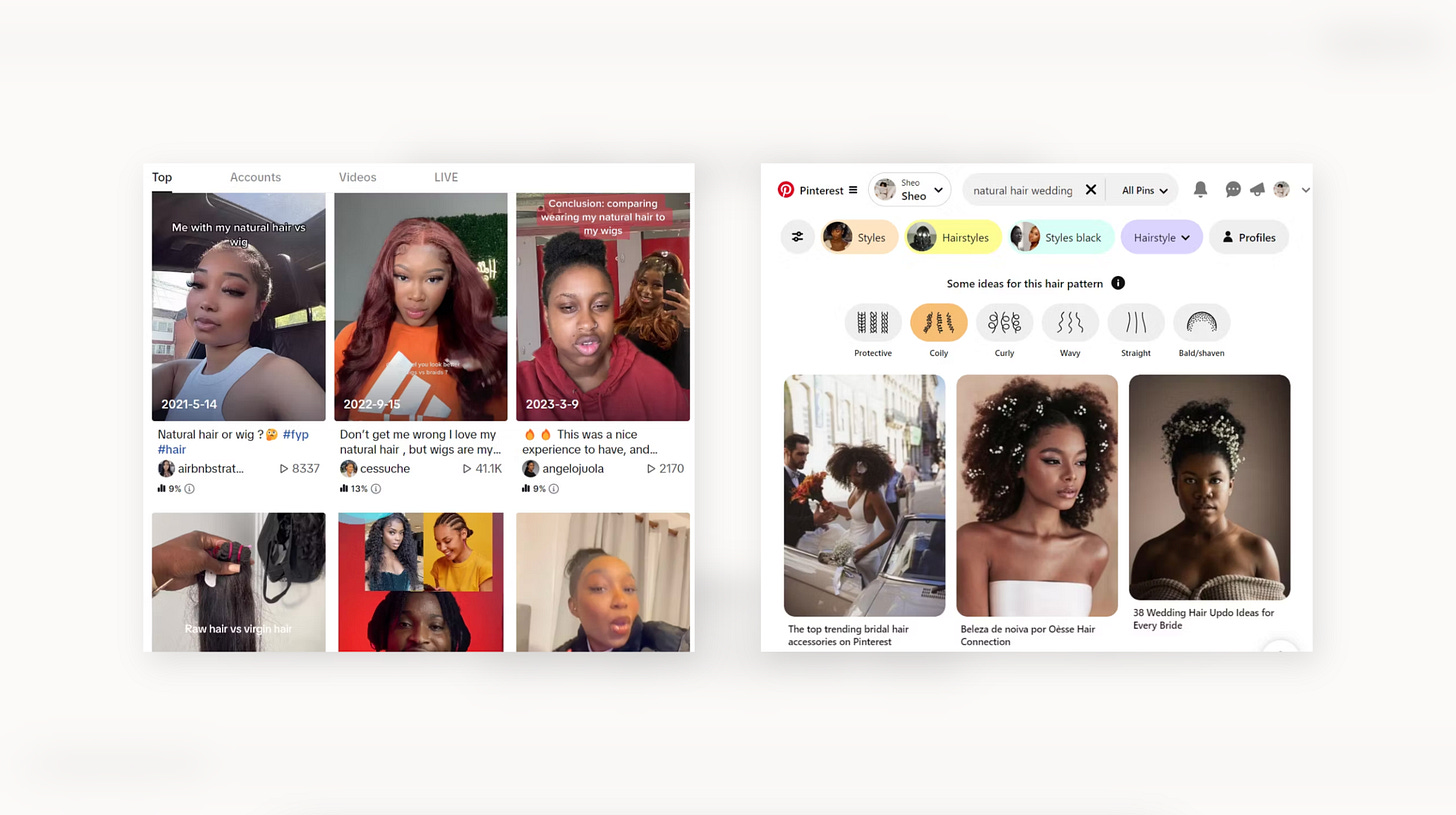

2️⃣ Social Listening on Native Platforms

TikTok, Pinterest, YouTube, and Reddit function as powerful search engines that reveal popular discussions and pain points. Unlike traditional search, these platforms show you the emotional context around problems.

Focus on content that's generating real engagement. A viral video with positive comment sentiment tells you more about real demand than an obscure post that happens to validate your existing assumptions.

Niche Reddit forums (also called subreddits) like r/curlyhair or r/beauty are filled with personal rants, raves, and product fails. What’s great about Reddit is that users often post context - what they’ve tried, why it didn’t work, and what they’re still looking for.

On other social channels, skip the brand-sponsored videos and go to the honest, low-production reviews, especially ones where people are trying to troubleshoot.

Listen for:

Repeated language around frustration

Mentions of confusion, inconvenience, or disappointment

Anything that starts with, “I wanted this to…”

You’d be surprised how many valuable insights you can get from just one 5-minute rant.

3️⃣ Solution Mapping

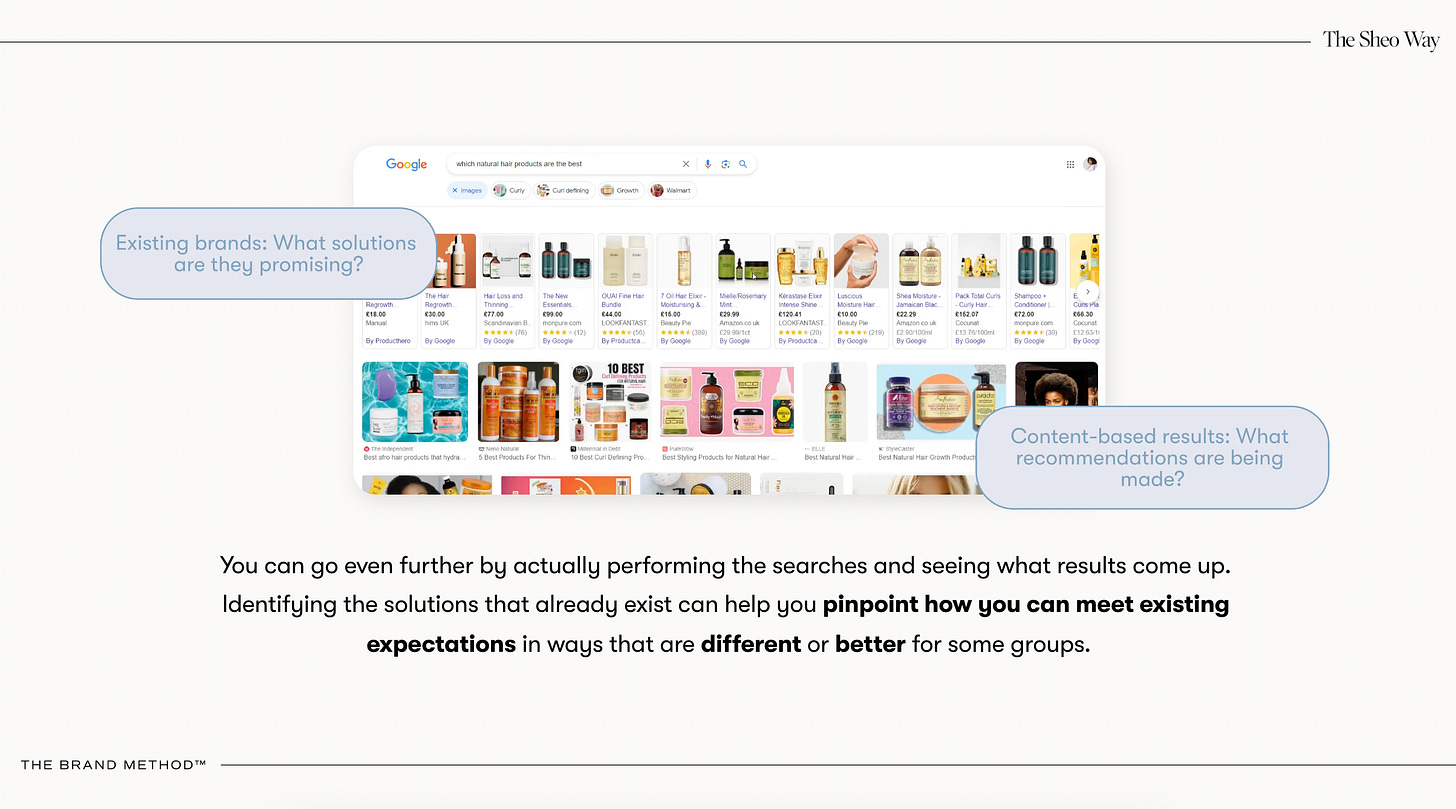

Once you've identified problems, research what solutions already exist. Perform the searches yourself and analyse what comes up.

If you see existing brands, what are they promising? If you see lots of content, what recommendations are being made?

You won’t be using this information to copy these brands. It will help you understand how you can meet existing expectations in ways that are either different or better for specific consumer groups.

Turning Data Into Insights

Raw data is meaningless without interpretation. The key is identifying patterns across multiple sources and translating them into actionable consumer insights.

For example, when researching natural hair care, patterns might emerge around:

Styling specificity: People asking how their hair will affect their overall look

Confusing terminology: Frustration with unclear product descriptions and hair typing systems

Product guidance: Overwhelm from trying multiple products that don't work

Range exploration: Interest in various styling options from natural to protective styles

You might find comments like:

“My twist-outs never last more than two days. It’s so annoying.” or “These products leave white flakes and make my hair feel heavy.”

Instead of guessing what product to make, you now know:

There’s a need for something that preserves styles longer

There’s demand for something lightweight, non-flaky, and deeply hydrating

People want styling results, but without the buildup or stiffness

Or, surface-level research might show people want product recommendations. But deeper research reveals they're frustrated by the expense of trial-and-error, questioning whether expensive really means better, and exploring DIY solutions to avoid waste and clutter.

Each pattern represents a potential opportunity to solve problems differently or better than existing solutions.

The most valuable insights come from understanding not just what people are searching for, but why they're searching for it and what's missing from current solutions.

This depth of understanding is what separates brands that solve real problems from those that create more clutter.

💡 Remember: sometimes the best problems to solve are ones you've experienced yourself, because you'll understand them more deeply. Your research then validates that it's a broader issue and helps you understand the nuanced ways it affects different people.

The goal isn't to find the most dramatic problem - it's to find clear, specific problems that matter enough to your target customers that they'll pay for better solutions.